Founded in 2015, Lieshi Venture Capital is a cross-border venture capital firm focused on the technology innovation sector, operating between China and the United States. It is the only venture capital firm in China where the founding team has over 20 years of experience in the semiconductor industry. The team possesses comprehensive technical and industry backgrounds, has deeply rooted connections in both Silicon Valley and China, and holds extensive resources in the tech industry, strong industry linkage and incubation capabilities, as well as a profound international perspective. The core team members are former executives from leading high-tech companies like Intel, with deep technical expertise and industry experience.

-

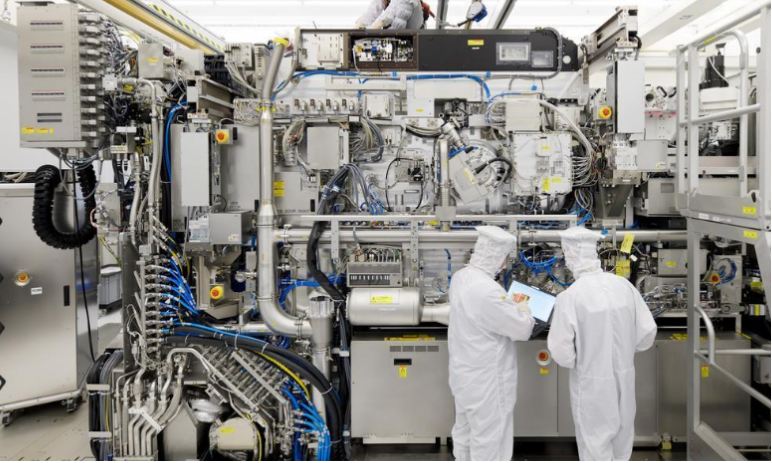

Advanced Equipment

Semiconductor equipment, core components of semiconductor, and medical instruments and meters.

-

New Materials

Semiconductor materials, aerospace materials, new energy materials, and military materials.

-

Artificial Intelligence

Computing power, high-speed interconnect technology, HBM (High Bandwidth Memory), and advanced packaging.

TEAM

-

EVAN ZHAO

Founding Partner

Mr. Zhao Meng has nearly 20 years of experience as a senior executive in the IT industry, as well as a strong background in investment. He has worked at international companies such as Microsoft and Intel for over 15 years, and has extensive work experience in the United States. With a deep understanding of both the Chinese and U.S. markets, he has cultivated valuable industry expertise and a wide network of connections. In 2015, Mr. Zhao officially founded Lieshi Venture Capital, focusing on venture investment in Mainland China, Silicon Valley, and Europe. He specializes in projects that innovate in product technology and business models, with a particular expertise in investing in advanced technologies. His rich network in the industries of both China and the U.S. greatly aids in identifying promising projects and supporting the growth of invested companies. With over 20 years of experience in multinational corporations and venture capital, Mr. Zhao has journeyed from an early-stage angel investor to the founder of a professional investment firm. He has achieved remarkable success, including growing the valuation of his investments by 1,000 times within four years. His influence is substantial in both the IT industry and venture capital sectors across China and the United States. Notable investments include companies such as XGIMI Technology (listed on the Science and Technology Innovation Board in March 2021, stock code: 688696), Ingkan Semiconductor, Muchuang Integrated Circuits, Jifeng Electronics, and Shenglian Technology, among others. Over the eight years since founding Lieshi Venture Capital, Mr. Zhao has led his team to achieve excellent performance.

-

Jackson He

CTO/Partner

Dr. He Jingxiang has over 30 years of experience in the global IT industry. He worked at Intel's U.S. headquarters from 1995 to 2018, serving for 23 years, including a six-year assignment from 2011 to 2017 as the General Manager of Intel Asia-Pacific R&D Co., Ltd. in China. Dr. He has held various leadership roles at Intel Labs, Intel IA Product Group, Intel Data Center Group, Intel Software & Services Group, and Intel AI Product Group. In recent years, Dr. He has focused on cloud computing, big data, and artificial intelligence solutions for the enterprise and internet industries. He has been a key driver of Intel's cloud computing initiatives in China and a significant advisor to the Open Data Center Alliance. He brings rich experience working with Chinese enterprises, telecom, and communication customers, and has represented Intel in various international standards organizations such as OASIS (Organization for the Advancement of Structured Information Standards), WS-I (Web Services Interoperability Organization), and DMTF (Desktop Management Task Force). Dr. He possesses deep technical expertise, industry experience, and management skills. His notable investments include companies such as Terrafuse, Chipu, Essense, and Huixi Intelligent.

-

OLIVE XU

Managing Partner

Ms. Xu Chen joined Lieshi Venture Capital in 2015, where she is primarily responsible for post-investment management and fund operations. Ms. Xu holds a Bachelor's degree in Economics from China Agricultural University, a Master's degree in Supply Chain Engineering from Wageningen University, and a Master's degree in Business Management from the University of Tasmania. With several years of experience in the IT industry, Ms. Xu has previously worked at international companies such as Kingdee, HP, and Intel. She has been in the fund industry for 9 years, participating in the establishment and operation of institutions from the ground up. She is well-versed in the operation of private equity funds and possesses extensive industry management experience and professional knowledge. Her expertise covers the entire process of fundraising, investment, management, and exit, including RMB funds, FOF funds, parallel funds, USD funds, and QFLP funds. Ms. Xu is familiar with the operational processes, information disclosure, and system applications of government-guided sub-funds. She oversees compliance and risk control, fund operations, post-investment management, finance, HR, and administrative affairs. Additionally, she conducts compliance and risk assessments for prospective investment projects and provides value-added services to invested projects, assisting with site selection and project implementation.

-

Wu Haihua

Project Director

Mr. Wu Haihua holds a Bachelor's degree in Mechanical Engineering and Automation, as well as a Master's degree in Business Administration, giving him a solid foundation in both technical and business disciplines. After graduation, he spent over 10 years in product development across various industries, including consumer electronics, industrial instruments, and industrial equipment, all within leading companies in their respective fields. With over six years of experience in full-chain semiconductor investments, Mr. Wu has developed a core investment philosophy and logic specific to the semiconductor industry and private equity investment. He has mastered industry and company analysis frameworks, due diligence methodologies, investment project selection and execution, and post-investment management. His investment portfolio includes projects such as Bocom Technology, Huaqin Technology, Synaptics TDDI Asia-Pacific Business, Ked Quartz, Jingyi Automation, Tiandeyu, Basic Semiconductor, Zhejiang Puchip, Huatu Microelectronics, Xinchip Semiconductor, Ningxia Dunyuan Juxin, Zhongxin Wafer, and Rongxin Semiconductor.

CONTACT

Grit Ventures

2303, block 2A, wangjing SOHO tower, yard 1, wangjing futong east street, chaoyang district, Beijing

Email: bp@gritvc.com